Table of Contents

- VOO vs SCHD: Which ETF is Better? — The Market Hustle

- SCHD Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- Schd Next Ex Dividend Date 2025 - Addy Crystie

- SCHD: I Was Wrong; It's Still A Loser In Today's Market | Seeking Alpha

- Why SCHD is the BEST Dividend ETF! - Investing. Upgraded.

- SCHD: Unlocking Massive Potential In The Next Rotation | Seeking Alpha

- SPGI vs SCHD Stock Latest News - SPGI News Today

- SCHD ETF Review - Is SCHD a Good Investment? (Dividend Stocks)

- SCHD: 3.50% Estimated Yield, 12% Dividend Growth, And More | Seeking Alpha

- Overview and Analysis of SCHD

What is SCHD?

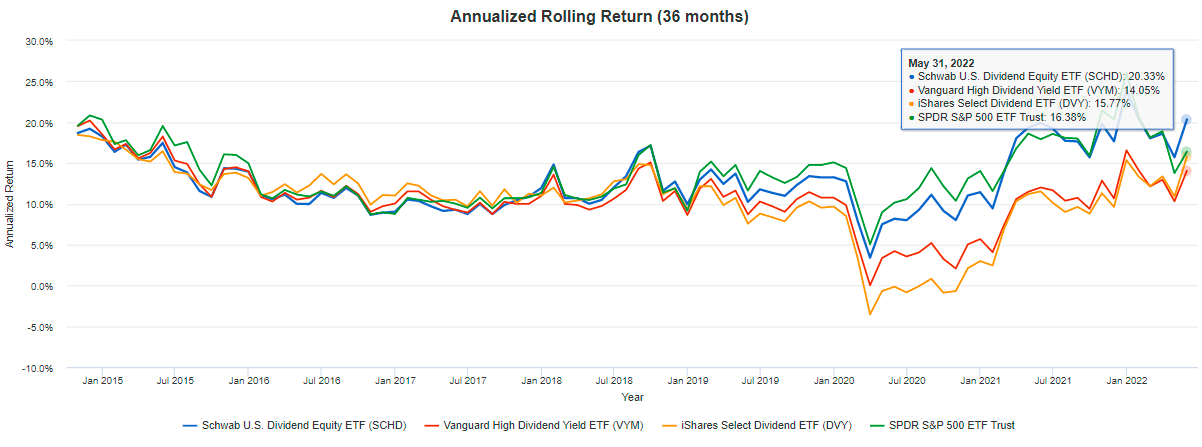

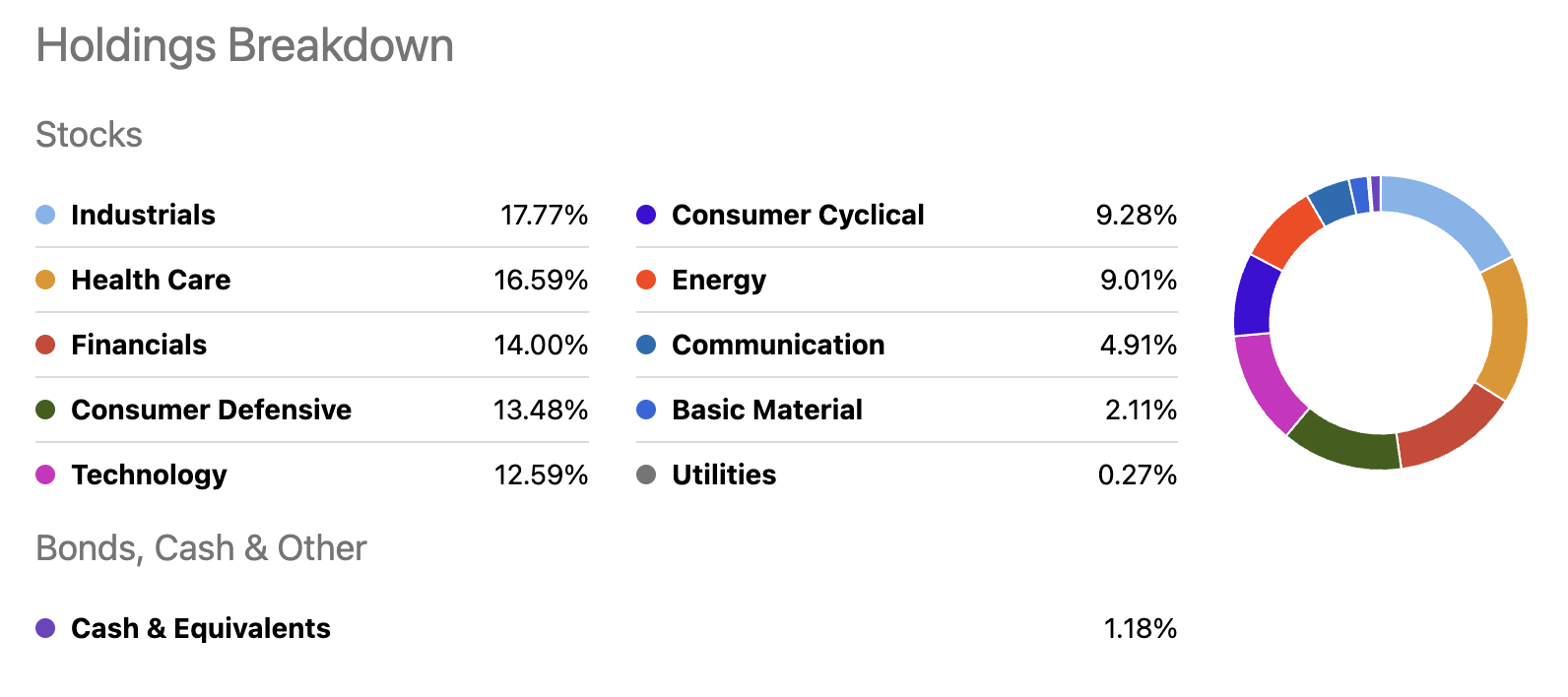

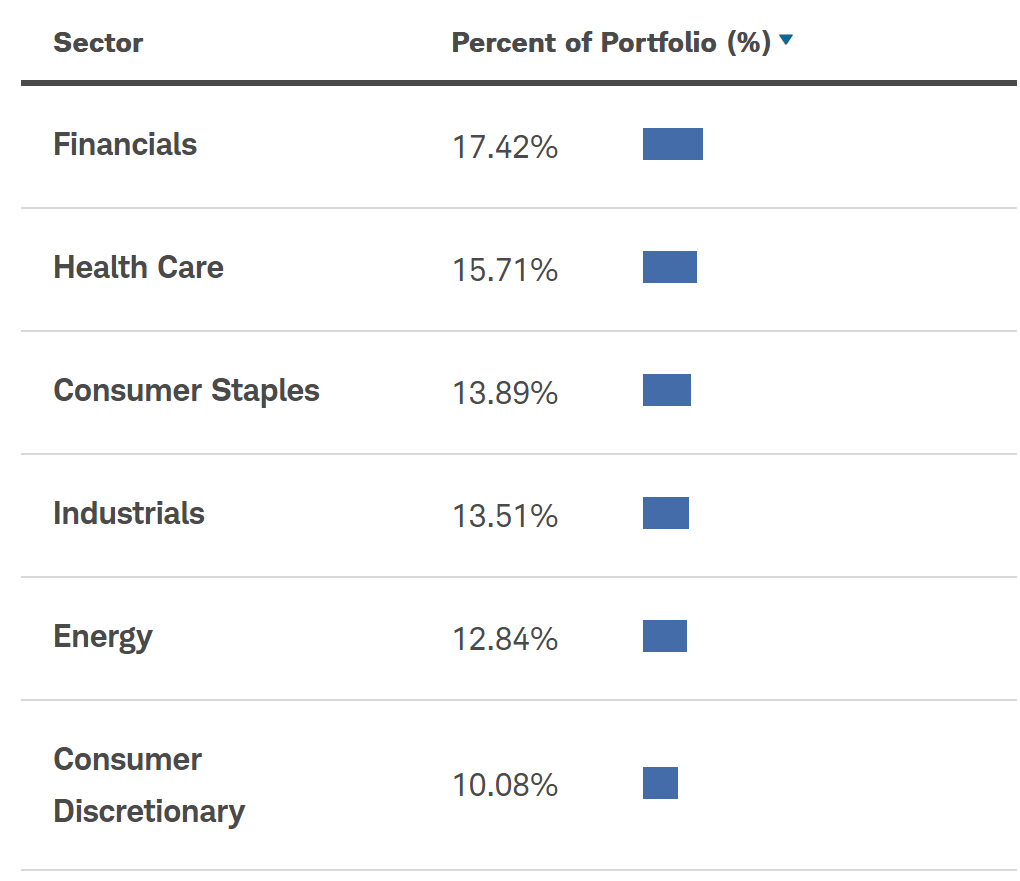

Investment Strategy

Benefits of Investing in SCHD

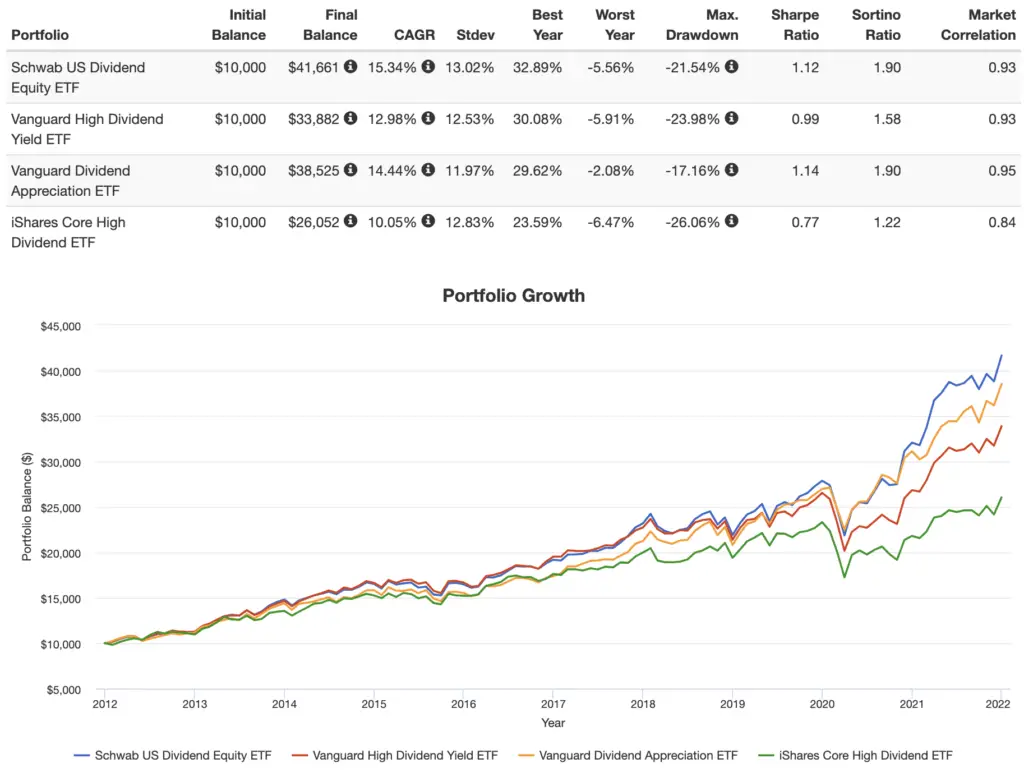

There are several benefits to investing in SCHD, including: Regular Income: SCHD's focus on dividend-paying stocks provides investors with a regular source of income, which can be attractive in a low-interest-rate environment. Diversification: By holding a portfolio of 100 stocks, SCHD offers investors a diversified portfolio that can help reduce risk and increase potential returns. Low Costs: SCHD has a low net expense ratio of 0.06%, making it an attractive option for cost-conscious investors. Flexibility: As an ETF, SCHD can be easily bought and sold throughout the trading day, providing investors with flexibility and liquidity.

How to Invest in SCHD

Investing in SCHD is relatively straightforward. You can purchase shares of the ETF through a brokerage account or a financial advisor. You can also invest in SCHD through a tax-advantaged retirement account, such as an IRA or 401(k). The Schwab U.S. Dividend Equity ETF (SCHD) is a popular option for investors looking to generate regular income from dividend-paying stocks. With its diversified portfolio, low costs, and flexibility, SCHD can be a great addition to a long-term investment portfolio. Whether you're a seasoned investor or just starting out, SCHD is definitely worth considering. By investing in SCHD, you can potentially benefit from the power of dividend investing and achieve your long-term financial goals.For more information about SCHD and other investment options, please visit the Schwab Asset Management website.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor or conduct your own research before making investment decisions.